Many angel investors got burned by investments in the heydays of cheap money. Now they are sitting...

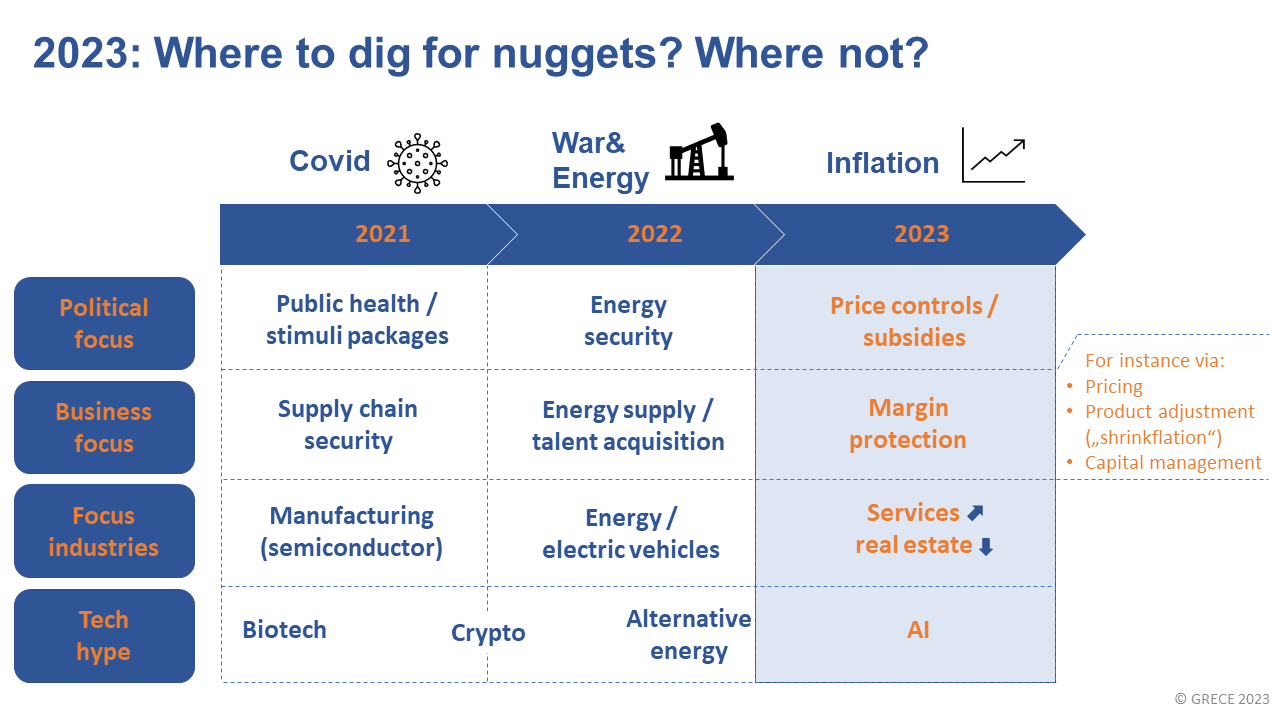

2023: Where to dig for nuggets? Where not?

Watch out for disruptions in real estate and knock-on effects in associated industries . High interest rates on mortgages will especially hit the (upper) middle class and industries driven by this segment (e.g., branded durables, cars). Lower income quartiles and mass-market service industries will do better. For businesses "margin protection" will be critical as (cost) inflation continues top-of-mind. The hype around OpenAI & ChatGPT is making AI – instead of Crypto – the "mainstream tech theme" of 2023.

Every of the past years was dominated by one top-of-mind topic: Covid in 2020/21, energy&war in 2022. This caused politics and businesses to react while some industries – for good or bad – came into the limelight. Politics seems slowest and reacts only towards the end of the cycle, thus reinforcing some issues already in the making. For instance, the Covid pandemic was petering out in 2021, but cheap money and public stimuli packages were still launched, preparing the ground for today`s inflation.

If this is a guide for 2023 – with inflation being top-of-mind – then price controls, subsidies and rising interest rates are aggravating future issues.

Even though finances of both businesses and households are constrained by rising rates not all sectors and segments are affected equally.

On the businesses side, capital intensive industries, such as manufacturing and real estate are affected most, plus banks that extend credit to those industries and households (mortgages). By contrast, services (e.g., restaurants, personal services) continue to do well as they enjoy pent-up demand from Covid-times while they are capital light and not severely affected by rising rates.

On the consumer side, households with mortgages will be the most hit while renters might even benefit from rent caps discussed in many countries. This increases the financial pressure on the (upper) middle class while lower stratospheres will not be hit that hard. For landlords and buy-to-let owners this could result even in a double whammy: rising rates and lower income due to rent caps.

Within businesses the focus will shift – from supply chain issues – towards margin protection: coping with cost inflation while increasing prices or adjusting products (“shrinkflation”). At the same time capital will be allocated more carefully which does not spell good times for capital expenditure and capital goods. The time of cheap money is over.

Thus, the finance function will have a strong hand in 2023 and, if you have the luxury to pick, the finance function seems a good spot for your career in 2023.

On the tech front the collapse of FTX has finally ended the (mass) euphoria around crypto, making it more of a niche topic of aficionados going forward. The hype around OpenAI and ChatGPT is making AI the „mainstream tech theme“ of 2023.

What does this mean for starting, developing or building a business?

- Real estate will be a difficult area, thus 2023 will not be good year for launching a Proptech business or Fintech focused on mortgages (unless it benefits from harder times in the real estate sector)

- Money will be tight in the (upper) middle class and B2C-businesses catering to this segment will have a harder time (e.g., branded durables, cars, high-end travel)

- Mass-market services (e.g., food delivery, package holidays) will do ok as the lower (middle) class will be hit less by rising rates and might benefit most from subsidies

- Finance will have the say in the corporate world with a focus on margins, pricing and cost containment … if you have the luxury to pick, this seems a good spot for your career in 2023

- The hype around OpenAI & ChatGPT is making AI – instead of Crypto – the new „mainstream tech theme“ of 2023 … ride the wave if you can!

Disclaimer: This is the opinion of the author and NO advice to invest into any mentioned industry or topic!